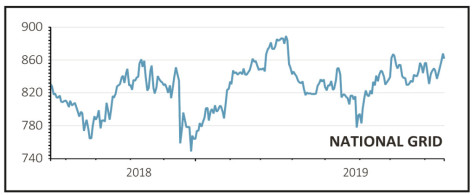

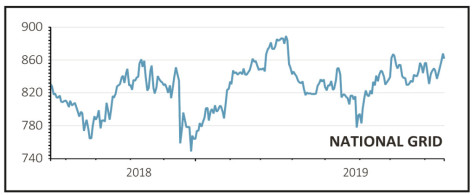

National Grid (NG.) 864.3p

Gain to date: 0.9%

The energy supply group National Grid (NG.) has been thrust into the news after a grid power blackout on 9 August, hitting homes, businesses and infrastructure. That prompted government ministers and regulator Ofgem to ask hard questions.

The media coverage since may have been unhelpful for a company which is responsible for keeping the lights on. Yet in investment market terms, the share price barely blinked, falling 1.5% in the immediate aftermath, losses that have been completely recovered since, with modest gains to spare.

That could change if Ofgem’s official probe ends up meaning a hefty fine for shareholders to stomach, although National Grid’s quick response and explanation to date seems to ease that threat.

Aside from this kerfuffle the big issues facing the group and investors remain the same; dividend sustainability in light of more hawkish regulator demands and longer-term, the threat of nationalisation in any future Labour government.

Quite how any of this will play out is impossible to say right now but looking at the stock market tea leaves suggests no need for panic.

SHARES SAYS

Analysts see this year’s annual dividend to 31 March 2020 increasing by roughly 3% to 48.79p per share implying a 5.65% yield, with similar incremental gains forecast for 2021 and 2022.

‹ Previous2019-08-22Next ›

magazine

magazine