Investor fears over the future of the global economy ramped up a notch this week as Germany’s central bank admitted the country could be heading for a recession.

The news adds to a so-called ‘wall of worries’, already featuring a no-deal Brexit and the looming prospect of an all-out unification bout between the US and China to declare the undisputed heavyweight (trade) champion of the world.

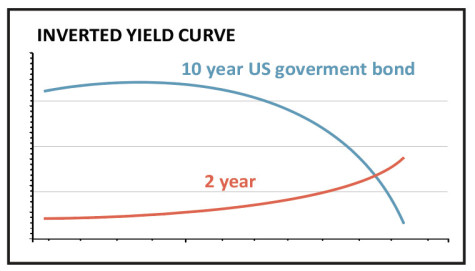

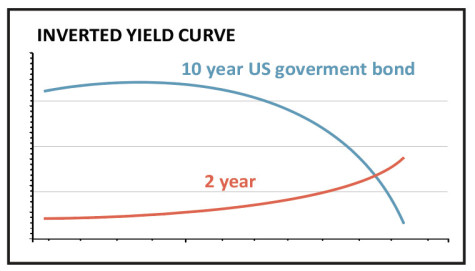

All of which has led to an inverted yield curve, which matters as it is historically a precursor to a global recession one or two years down the line.

An inverted yield curve is where the return on short-dated government bonds is better than the return on long-dated ones.

Two-year US Treasuries, UK gilts and German bunds give a better return than 10-year ones, while something similar has been seen in government bonds from Japan, Australia, Hong Kong, Singapore and South Korea.

Bond investors normally expect to get a better return for holding bonds that aren’t due to be repaid for a long time because of the added risk.

But now with yields negative on some 10-year bonds investors are effectively paying to lend the government money because they’d rather guarantee a small loss now than risk a big one later on.

Fund managers, analysts and economists believe such indicators point to an imminent global recession, but others think the worries could be overblown.

The fortune of the world’s economy is typically tied to how the US does, and both president Donald Trump and his chief economic advisor Larry Kudlow have both dismissed the prospect of a recession, with Kudlow optimistic on the US economy.

Emerging market investors hit by Argentina

Argentina has been in the doldrums recently, and the past week has seen the economy minister resign with the country’s currency shedding 20% of its value against the dollar.

That came after market-friendly president Mauricio Macri suffered a resounding defeat in the first poll of the country’s elections.

And it has hit some emerging market investors hard. Star fund manager Michael Hasenstab, who runs bond funds for Franklin Templeton, lost $1.8bn in a single day as he had a lot of money invested in Argentine bonds.

But he might not be the only one affected. Though Argentina only makes up 2.6% of the commonly used MSCI Emerging Markets Index, JP Morgan noted that investing in Argentine stocks was one of the most popular trades by emerging market investors last month.

‹ Previous2019-08-22Next ›

magazine

magazine