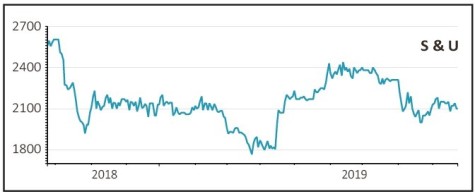

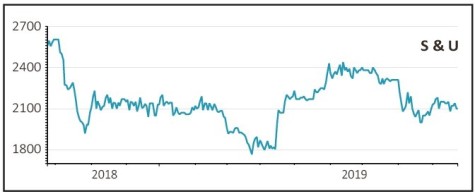

S&U (SUS) £21.40

Loss to date: 4%

Shares in motor finance and bridging loan provider S&U (SUS) have traded in a narrow range since we said to buy in May at £22.20, despite steady progress in the business.

The non-prime segment of the used car market serviced by S&U’s Advantage motor finance brand has been relatively immune to the challenges facing the new car market and applications for loans continue to hit record levels.

That has allowed Advantage to be more selective in whom it lends to and the terms it sets, which means that the quality of its lending has improved.

The appointment of Graham Wheeler, who brings many years of finance experience at VW and Jaguar Land Rover, to head up Advantage is also a positive move.

Meanwhile the property lending business, Aspen Bridging, has also seen record loan enquiries but a prudent approach means the loan book remains high quality.

Since inception more than half of Aspen’s 137 loans have been repaid in full and only one has experienced impairment, which was a loss of some default interest rather than capital.

Both the used car market and the new home market offer plenty of room for growth, and on 8.5 times this year’s earnings with a 5.8% dividend yield the shares still look good value.

SHARES SAYS: Keep buying S&U

‹ Previous2019-09-26Next ›

magazine

magazine