China is one of the world’s largest economies yet its stock market can be difficult for private investors, and even some professionals, to follow.

There are three main types of Chinese share.

A-shares: renminbi-denominated shares in mainland China-based companies whose ownership is restricted to mainland citizens and foreigners under the regulated Qualified Foreign Institutional Investor system.

B-shares: quoted in foreign currencies (such as the US dollar) and can be purchased by domestic and foreign investors (with a foreign currency account).

H-shares: Hong Kong dollar-denominated shares in Chinese companies which are listed in and trade on the Hong Kong Stock Exchange.

Chinese firms which are listed and trade on the Hong Kong Stock Exchange have typically been the most accessible for overseas investors – although markets in mainland China are slowly beginning to open up to foreign institutions.

Hong Kong has been in the spotlight not just due to simmering tensions and ongoing demonstrations but also in the financial world following the £32bn bid from Hong Kong Exchanges and Clearing for London Stock Exchange (LSE). A move which has been firmly rebuffed.

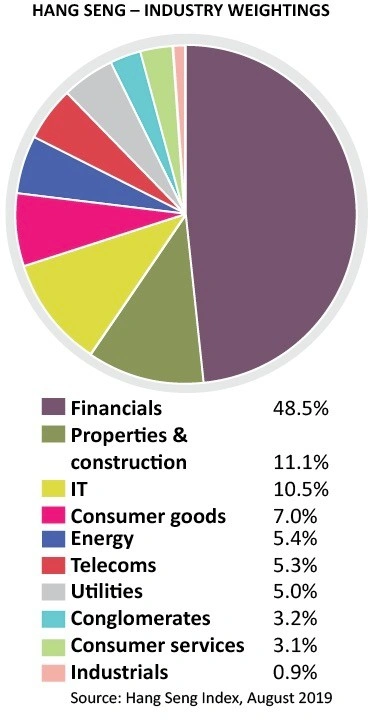

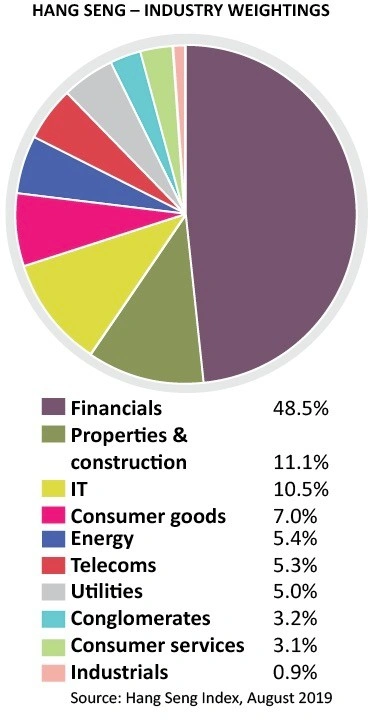

The main stock index in Hong Kong is the Hang Seng. The unhelpful political situation in the country and the ongoing trade war between China and the US has seen the index really lag global peers so far in 2019 – up just 3.5% against a 9% rise for the FTSE 100, 9.9% gain for the Nikkei 225 and 19.9% advance for the S&P 500.

And a long way behind emerging markets such as Russia up 29% and Brazil’s Bovespa index which is up 18%. As of the end of August the index traded on a price-to-earnings ratio of 10.2 times and offered a yield of 3.8%.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here

‹ Previous2019-09-26Next ›

magazine

magazine