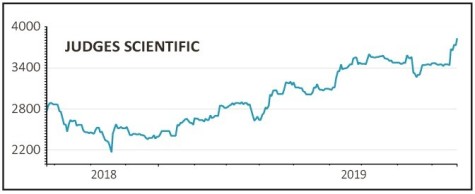

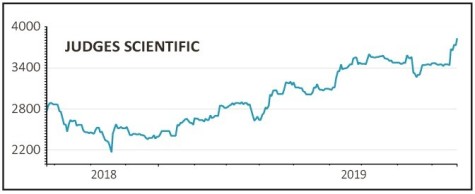

JUDGES SCIENTIFIC (JDG:AIM) £38.30

Gain to date: 68%

Half year results delivered everything investors could have desired, underlining once again how science kit maker Judges Scientific (JDG:AIM) is a high quality business.

New first-half records were set for revenue, adjusted pre-tax profit, earnings per share, cash generation and dividends, the latter up 25% to 15p per share that is still covered seven times by adjusted earnings. All of this growth was achieved without any help from acquisitions.

That the share price jumped 7% on the day (18 September) and has continued its steady rise stands testament to how increasing numbers of investors like the stock.

Stockbroker Shore Capital increased its earnings per share forecasts by 9.2% to 208p for 2019, and by 5.2% to 208.2p for 2020.

Our original article claimed the stock deserved a higher price-to-earnings earnings multiple than 14.8 times 2019 earnings. The shares have jumped 68% yet the rating still only stands at 18.4 which is not excessive given its qualities and achievements.

SHARES SAYS: A very good business that we continue to support. Keep buying the shares.

‹ Previous2019-09-26Next ›

magazine

magazine