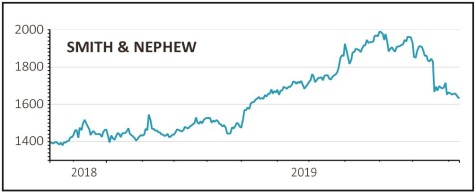

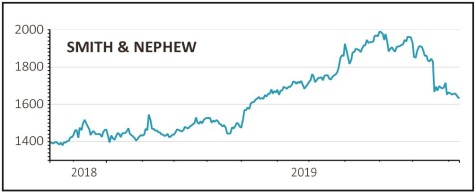

Smith & Nephew (SN.) £16.33

Loss to date 14.4%

Original entry price: Buy at £19.09, 8 August 2019

Diversified medical devices maker Smith & Nephew (SN.) has twice upgraded its expectations for revenue growth in the past six months, demonstrating that the new operational structure is seeing tangible and sustainable commercial benefits. Sadly the shares have recently taken a dive.

On 21 October chief executive Namal Nawana resigned, reportedly over pay, to be replaced by Roland Diggelmann, who was the chief executive of Roche Diagnostics. The shares fell 9% on the day and have drifted lower since the announcement.

Nawana wanted to make acquisitions in faster growing areas and was targeting higher debt levels to accommodate up to $1.5bn of further deals.

While there aren’t doubts about the business continuing as usual under the senior management team, the acquisition side of the equation is now under more scrutiny until we hear from the new chief executive.

Narrowing the trading margins guidance from 22.8%-23.2% to ‘around 22.8%’ on 31 October also troubled investors even though this was only caused by foreign exchange, inward investment and recent acquisitions rather than something major.

We originally said the shares weren’t cheap on 21.4 times forecast earnings and they have since de-rated slightly to 19.4-times.

SHARES SAYS: We see no reason to change our positive view while business momentum remains strong.

‹ Previous2019-11-14Next ›

magazine

magazine