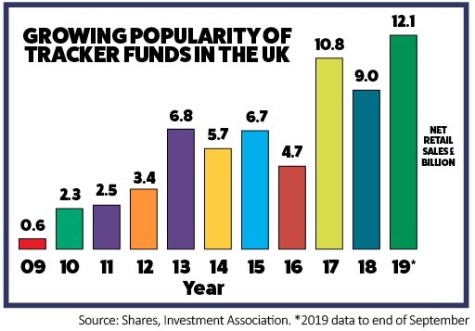

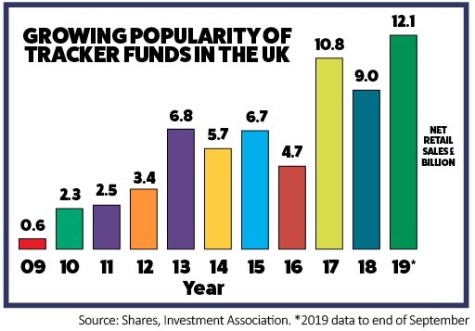

The latest data from the Investment Association (IA) shows that investors are increasingly taking money out of actively-managed equity funds and putting cash into tracker funds and bond funds.

This could possibly be explained by investors becoming increasingly frustrated at many fund managers failing to outperform, as well as weak sentiment towards active management following the Woodford debacle.

Tracker funds, which include exchange-traded funds (ETFs), offer a low-cost way of simply tracking the markets.

As for the move into bonds, that’s probably down to two reasons: a defensive move for fear that equity markets may have peaked, as well as chasing performance with bond prices shooting up this year.

The IA – which is a trade body for UK investment managers – found that £4.6bn of money was taken out of equity funds in the UK in third quarter of 2019, half of which was in products that invest in the UK stock market.

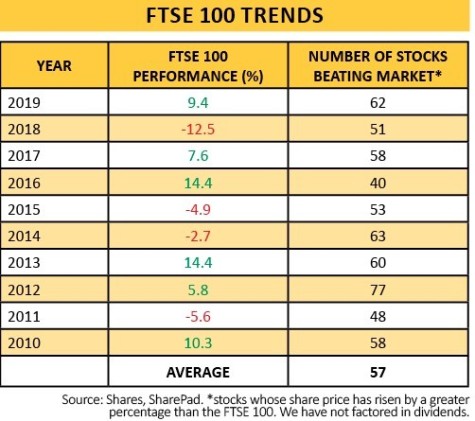

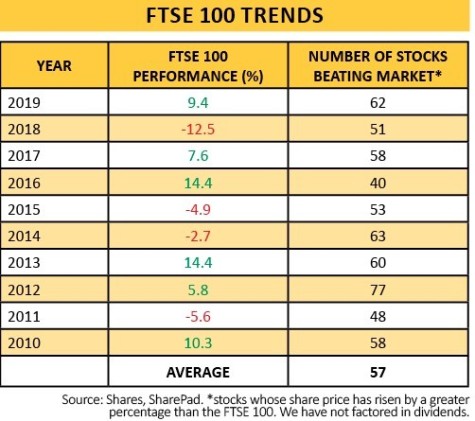

If we take the FTSE 100 as a way of representing the UK stock market, the accompanying table shows how that index has performed each year over the past decade and how many stocks have outperformed.

This year’s performance has a higher than average number of stocks beating the market cap-weighted index as a whole at 62 versus the average of 57.

The data therefore suggests there has been plenty of scope for active fund managers to beat the market if they’d chosen the right stocks. That assumes their investable universe is restricted to the FTSE 100 which is unlikely to be the case for most managers – but it does give you an illustration of the outperformance potential.

Nearly as much money went into tracker funds in the UK during the third quarter of 2019 as the whole of 2016 (£4.6bn versus £4.7bn respectively, on a net retail sales basis).

This situation is putting active managers under increasing pressure to justify their fees otherwise investors will simply move to passive tracker funds where a fund manager isn’t required to pick the underlying assets.

Passive funds still have a long way to go before they have a chance of being more widely held than active funds but the trend is clearly for greater adoption in the UK.

‹ Previous2019-11-14Next ›

magazine

magazine