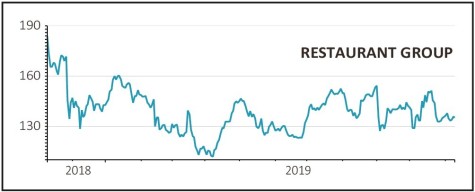

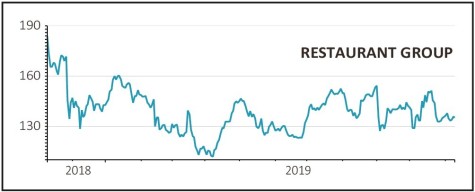

Restaurant Group (RTN) 139.8p

Gain to date: 23%

Original entry price: Buy at 113.2p, 11 April 2019

Shares in casual dining firm Restaurant Group (RTN) have stalled a little since a disappointing set of first half results at the beginning of September. We said then to stick with the shares but recent signs of a deteriorating backdrop means now is a good time to book a decent profit.

The latest Coffer Peach Business Tracker, a key measure of sales for the pub, bar and restaurant trade, showed like-for-like sales down 0.7% in October among restaurants.

It seems unlikely Restaurant Group would have proved immune to this negative trend which could undermine efforts to turn around the struggling Frankie & Benny’s and Chiquitos chains as well as knocking its ambitions for Wagamama off course.

There also seems to be a chance that chief executive Andy Hornby, who took over on 1 August, might look to reset expectations a little now he has got his feet under the table at the business.

Based on previous years the company is next likely to update the market at the beginning of January with a full year trading update and there looks an increasing chance the company could disappoint when it does.

SHARES SAYS: Take profit as the trading environment gets tougher.

‹ Previous2019-11-14Next ›

magazine

magazine