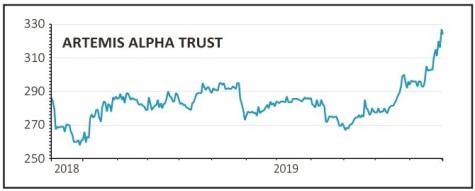

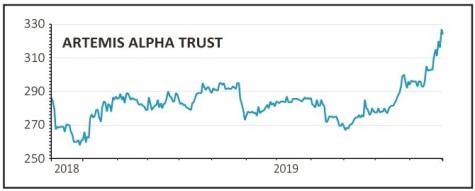

Artemis Alpha Trust (ATS) 327p

Gain to date: 14.5%

Original entry point: Buy at 285.5p, 25 July 2019

Revamped investment trust Artemis Alpha Trust (ATS) is alive to a growing number of prospective investment opportunities according to its latest factsheet.

This suggests the company has scope to continue the repositioning of the portfolio to higher quality companies which enjoy competitive advantages in industries with supportive dynamics and are led by excellent management teams.

In the November update, managers John Dodd and Kartik Kumar note ‘our pipeline of potential holdings is busier than it has been for some time’.

The discount to net asset value (NAV) has narrowed since we said to buy in July but still remains material at 12.2% and the company is buying back its own shares in an attempt to go some way towards narrowing the gap further.

The portfolio has benefited from reduced fears of a no-deal Brexit with Sports Direct (SPD), Barclays (BARC) and Just Eat (JE.), the latter subject to a bidding war between Dutch firm Takeaway.com and tech group Prosus, all strong contributors to recent performance.

SHARES SAYS: The shares remain at a double-digit discount to NAV and we believe this can narrow further.

‹ Previous2019-12-05Next ›

magazine

magazine