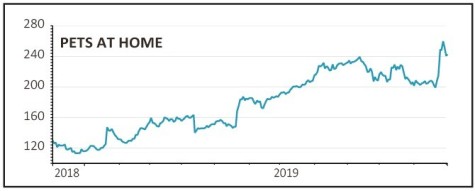

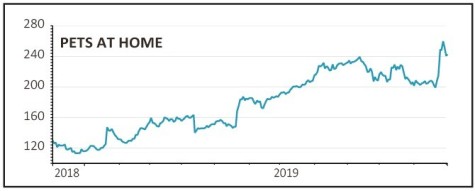

Pets at Home (PETS) 242.6p

Gain to date: 13.9%

Original entry point: Buy at 213p, 5 September 2019

An excellent set of first half results (26 Nov) has fired up shares in pet retailer Pets at Home (PETS) and suggests its recovery story is gaining momentum.

We have been vindicated for keeping faith with our positive view as per an update on the stock in our 19 November issue. The weakness in the shares ahead of the half year numbers proved to be an excellent buying opportunity.

Underlying pre-tax profit in the six months to 30 September was up nearly 19% to £45m and guidance is for full year profit growth at the top end of market expectations.

The company has been facing pressure from rising online and discounter competition, but chief executive Peter Pritchard has made clear progress in turning things around since taking the helm in April 2018.

This has been built on getting the basics right, serving the right products to the right customers through the right channels more efficiently.

The next step is to sign an increasing number of customers up to its full range of products and services. Investment bank Liberum is already sufficiently impressed to describe the turnaround as ‘one of the most impressive we have seen within the UK retail sector’.

SHARES SAYS: Keep buying.

‹ Previous2019-12-05Next ›

magazine

magazine