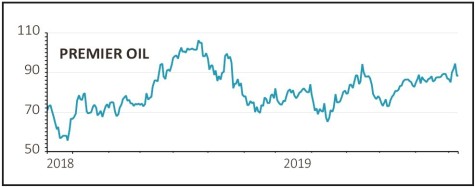

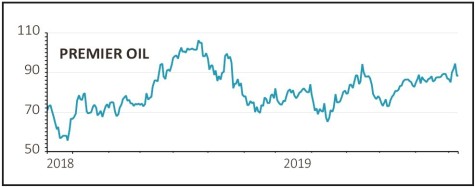

Asia Research & Capital Management, a privately-owned asset management firm based in Hong Kong, has built up one of the largest ever short positions (£132m) in the UK market, targeting oil firm Premier Oil (PMO).

Short-selling is betting that a share price will fall. It involves borrowing stock from institutional investors and then buying the shares back at a lower price in the market and pocketing the difference.

According to shorttracker.co.uk, Premier Oil has 20.5% of its shares held short, with ARCM representing 16.9%.

A high percentage of shares held short would usually be a signal that hedge funds were making a directional bet that the shares were likely to fall, but in the case of Premier Oil it seems that ARCM’s motive is to hedge its approximate $380m holding in the company’s debt which is repayable in May 2021.

Bond holders are higher up the legal pecking order than equity investors, and so in the event of a company failing to meet its debt obligations, equity holders often get wiped out. If this happened ARCM would make a 100% profit on its short position.

The difference in value between the bond and equity investment represents the estimated recovery value should Premier Oil default on its bonds.

‹ Previous2019-12-12Next ›

magazine

magazine