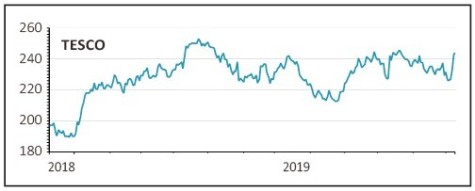

TESCO (TSCO) 243.2p

Gain to date: 2.7%

In anticipation of a tough summer compared with last year’s abnormally strong sales, in the spring Tesco (TSCO) reduced its number of product lines and put more resources into its own-brand offerings, but growth has remained elusive. UK like-for-like grocery sales were down 0.3% in the first half, although this was partly offset by strong growth at its wholesale business Booker.

Since the summer the priority for chief executive Dave Lewis has been to streamline the business before handing the reins to Ken Murphy who joins from Walgreen Boots Alliance next year.

In September, the mortgage business was sold to Lloyds (LLOY) for £3.8bn, a slight premium to its £3.7bn book value. The sale not only generated a healthy cash inflow, allowing Tesco to reinvest in prices to maintain market share, it also meant it no longer had to put capital behind a business with minimal profits.

This week Tesco confirmed it is considering the sale of its Malaysian and Thai businesses after receiving an unsolicited approach. The Asian businesses should fetch a good price, allowing the grocer to continue focusing on its home market.

With consumer confidence subdued due to election uncertainty, Britain’s biggest retailer is in pole position to benefit once spending picks up again.

SHARES SAYS: We continue to back Tesco in the battle for shoppers’ wallets. Buy.

‹ Previous2019-12-12Next ›