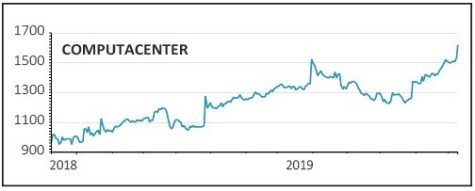

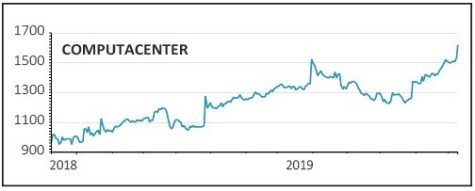

Computacenter (CCC) £16.52

Gain to date: 36.5%

Our faith in IT business Computacenter (CCC) continues to be rewarded. A trading update on 10 December revealed full year profit and earnings per share would be ‘well ahead’ of current market forecasts due to a strong showing from established businesses and its recent US acquisition, FusionStorm.

The improvement at FusionStorm is encouraging after it endured a difficult first half. The group is also benefiting from the fact that a number of problem contracts, which involved material provisions in 2018, are now performing in line or slightly ahead of expectations.

Computacenter says is still has plenty to do in December, typically its busiest month, but also says visibility is starting to improve. Investors don’t have too long to wait to hear how December went, with a pre-close trading update scheduled for 23 January.

We still like the company’s three-pronged strategy of selling computer equipment, software and providing outsourced IT solutions. This approach has delivered steady growth, robust profit and cash flow and generous dividends over several years and that shows little sign of changing.

SHARES SAYS: Still a buy

‹ Previous2019-12-12Next ›

magazine

magazine