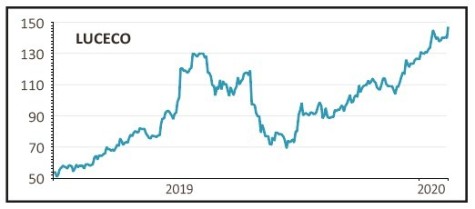

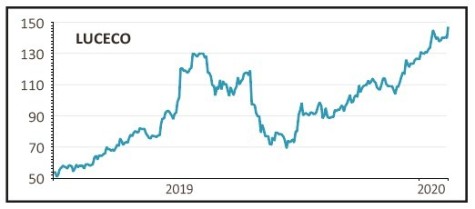

LUCECO (LUCE) 148p

Gain to date: 27.6%

Original entry point: Buy at 116p, 19 December 2019

Confirmation that electronics components and LEDs firm Luceco (LUCE) has traded ahead of expectations during 2019 is a clear sign of the margin improvement potential we highlighted in our original article.

To recap, Telford-based Luceco supplies a large collection of electrical and wiring products to both retail and wholesale providers, covering industries such as commercial construction, residential housebuilding and housing maintenance.

This week the company revealed that it will beat forecasts for 2019, on an adjusted operating profit basis, and anticipates doing so for 2020 too.

Expectations for 2019 were pitched at £17.3m versus the £17.5m to £18m the company will chalk-up. For 2020, Luceco expects £20.5m versus the £19.4m previous forecast.

We said in the original article that Luceco ‘has the scope to repair profit margins from the high single digits of today to the mid-teens of the past’.

In 2018 operating profit margins were 5.2%. For 2020 Numis now anticipates 11.5%, versus the 10.8% previously forecast. Gross margins exited 2019 at 37%, compared to the 30.9% of 2018.

Stronger balance sheet and cash flow give Luceco the scope to hunt for value-adding acquisitions through the rest of 2020.

SHARES SAYS: A great start to 2020, we see more progress

through the rest of this year.

‹ Previous2020-01-30Next ›

magazine

magazine