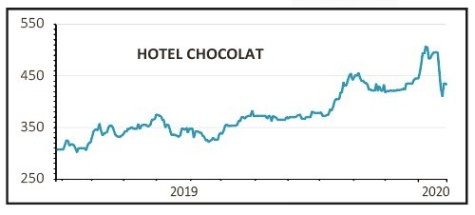

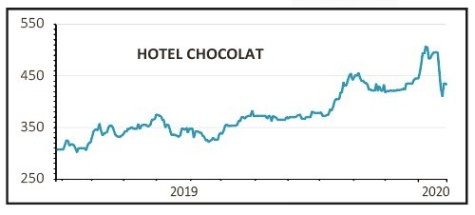

Hotel Chocolat (HOTC:AIM) 430p

Gain to date: 1.5%

Original entry point: Buy at 423.5p, 19 December 2019

The latest update from premium chocolatier Hotel Chocolat (HOTC:AIM) was slightly mixed but we still remain positive on the company, which is one of our ‘10 winning stocks for 2020’ selections.

On 23 January the company reported 11% revenue growth for the 13 weeks to 29 December, in line with management expectations. For the 26 weeks to the same date growth was 14%.

The fly in the ointment was inefficiencies in the supply chain which increased the cost of delivering this growth.

The company appears to be on top of these issues and in part they reflect the scale of the international opportunities the business is

chasing. Overseas growth was a key reason behind our original ‘buy’ rating on the stock.

Liberum comments: ‘The costs to drive this growth have been higher than expected, which will support an acceleration of the adaption of

the supply chain from a UK-centric model to a global multi-channel one in 2020.

‘This comes at a time when management is increasingly confident that the joint venture in Japan and its business in the US are showing strong signs that growth could accelerate in the medium-term.’

SHARES SAYS: We remain focused on the longer-term prize and believe the shares are still worth buying.

‹ Previous2020-01-30Next ›

magazine

magazine