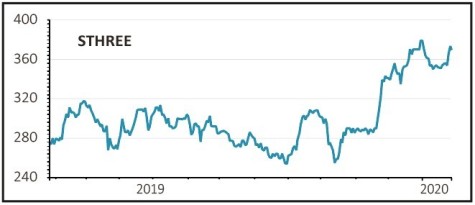

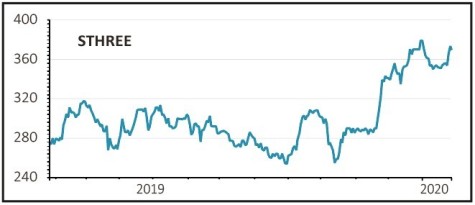

SThree (STEM) 365p

Gain to date: 25.9%

Specialist staffing business SThree (STEM) delivered strong full-year results with net fee income up 5% to £342.4m and operating profit up 9% to £60m. Growth in net fees came in spite of a fall in permanent placings and a double-digit rise in 2018.

The technology hiring business, which generates 45% of net fees, grew by 7% with continued strong demand in continental Europe especially for higher-value contract staff.

Energy and engineering, the next-biggest business, saw positive growth in Europe but US fee growth was exceptionally strong at 38% and a strong finish to the year means there is good momentum moving into 2020.

The life sciences division also saw increased demand, including in the UK and Ireland, while the legacy banking and finance business – which now accounts for barely more than 10% of net fees – was the only area to show a decline.

Chief executive Mark Dorman was cautious for 2020 given that ‘broader macro-economic and political uncertainties may well persist, and the trading environment remains similar to Q4’,

but there is no doubt that the company’s focus on the science,

technology, engineering and mathematics (STEM) markets and higher-value contract staff is paying off.

SHARES SAYS: SThree is well positioned to benefit from STEM demand and we remain buyers.

‹ Previous2020-01-30Next ›

magazine

magazine