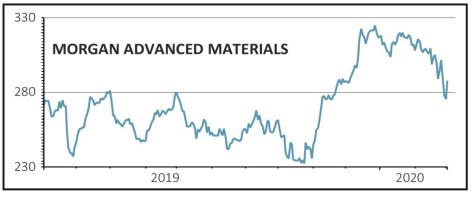

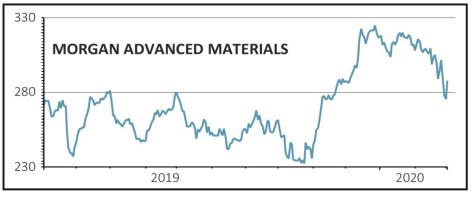

Morgan Advanced Materials (MGAM) 285.4p

Gain to date: 15.9%

With the coronavirus causing ructions across China and elsewhere Morgan Advanced Materials’ (MGAM) shares have held up well. The FTSE 250’s stock is down less than 5% since the panic selling started, despite the company earning 10% of revenue from China, where it is dealing with an extended shutdown of its manufacturing facilities.

Morgan, which designs smart materials to create more advanced and energy efficient products, is predicting that faster-growth markets such as semiconductors will offset likely weak industrial and automotive segments in 2020.

That’s partly due to the company’s technological breadth and expertise, but important self-help is also paying off, such as stripping out costs, streamlining products and improving organic growth through better sales processes.

Morgan reported £109.7m pre-tax profit for 2019, up from £94.9m in the previous year.

Risks to consider include unfavourable foreign exchange rates and prolonged disruption in China. However, new products should emerge from its development labs which should command higher prices.

Analysts forecast adjusted pre-tax profit of £115.5m and earnings per share of 25p in 2020, rising to £120.1m and 26.1p respectively in 2021.

SHARES SAYS: Short-term risks cannot be discounted but the stock continues to look good value on 11 times forecast earnings for 2020.

‹ Previous2020-03-05Next ›

magazine

magazine