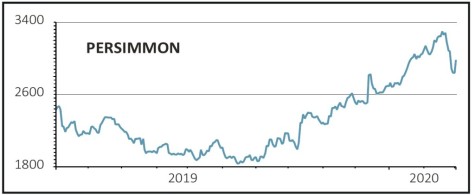

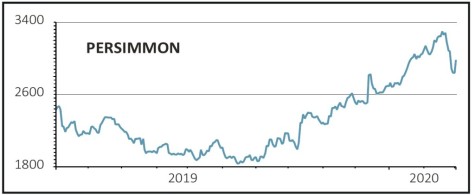

Persimmon (PSN) £29.84

Loss to date: 7.2%

Original entry point: Buy at £32.15, 20 February 2020

We remain positive on housebuilder Persimmon (PSN) despite the surprise resignation of chief executive David Jenkinson who had only been in the job for just over a year.

His predecessor Jeff Fairburn was forced out following a shareholder revolt over his pay. Jenkinson is now leaving following several customer complaints and a scathing independent review which criticised the corporate culture inside the company.

In Persimmon’s full year results to 31 December, it reported a 2.4% drop in revenue to £3.65bn as well as slight falls in pre-tax profit and earnings per share.

However chairman Roger Devlin, who commissioned the independent review, hailed Jenkinson’s ‘critical’ role in developing the ‘new Persimmon’.

Devlin said: ‘As chief executive he quickly set about designing and implementing a programme of change and started the process of resetting the culture of the business.

‘Under his leadership Persimmon has invested in a range of customer care and quality initiatives, prioritised customers over volume, became the first UK housebuilder to implement a retention policy and will achieve an HBF 4-star rating.’

SHARES SAYS: We remain buyers of Persimmon as it repairs its reputation and improves its building practices. High margins and a exceptionally strong balance sheet put it in a better position than its rivals to capitalise on momentum in the housebuilding sector.

‹ Previous2020-03-05Next ›

magazine

magazine