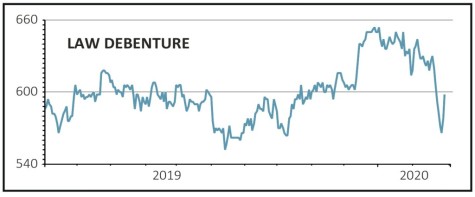

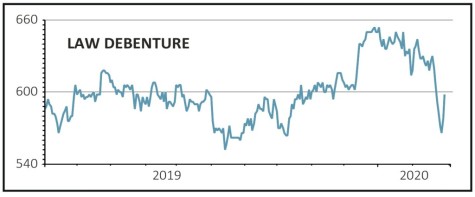

Law Debenture (LWDB) 610p

Gain to date: 5.5%

Our ‘buy’ call on Law Debenture (LWDB) is in the money even after this unusual trust got caught up in the recent sell-off.

We’re staying positive following full year results (27 Feb) which revealed an impressive net asset value (NAV) total return of 17.9% for 2019, with the share price total return of 24.5% handily outpacing the wider UK stock market.

A trust with a twist – in addition to a portfolio of stocks the company also provides services to corporate trust and pension trustees – Law Debenture provides an added element of diversification as performance isn’t solely reliant on the direction of the stock market.

Besides a 25% increase in portfolio income, Law Debenture’s Independent Professional Services (IPS) business enjoyed another year of good growth, supporting a step change in the final dividend which was lifted 50% to 19.4p. The trust will also increase the frequency of dividends to quarterly payments.

Portfolio managers James Henderson and Laura Foll continue to find attractive opportunities among unloved UK domestic stocks, while chief executive Denis Jackson sees growth potential across the IPS businesses as a result of increased market focus on ESG issues.

SHARES SAYS: We remain bullish about Law Debenture for its dividend growth, defensive attractions, low ongoing charges and long-term record.

‹ Previous2020-03-05Next ›

magazine

magazine