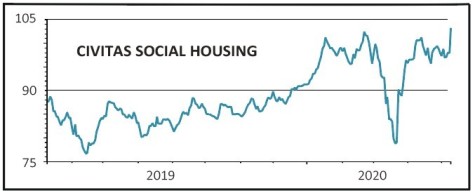

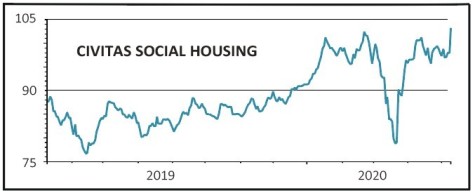

Civitas Social Housing (CSH) 103.8p

Gain to date: 7.6%

Our positive call on social housing investor Civitas Social Housing (CSH) has received some early validation in the form of the company’s latest update (11 May).

We flagged Civitas as a reliable source of income and so it was encouraging to see the dividend fully covered by earnings and a planned 1.9% increase in the payout for the March 2021 financial year, ahead of its inflation-linked target.

The company, which still trades at a slight discount to its updated net asset value per share of 107.87p, provides specialist accommodation to people with learning disabilities and mental health disorders.

Rent is paid by local authorities, supported by central government. Civitas had received 99% of the sums due for the first quarter and second quarter rent collection has so far been unaffected by the coronavirus.

Investec comments: ‘Civitas has £49m of cash although £24m is committed; £212m of properties remain unencumbered (by debt) and available as security for additional borrowing in due course.’

The company says it is in active discussions over the potential acquisition of a range of high-quality existing and new build properties. It is soon to complete on the purchase of a portfolio of specialist facilities in Wales which will contribute to growth in rental income.

SHARES SAYS: Still a solid buy for income seekers.

‹ Previous2020-05-14Next ›

magazine

magazine