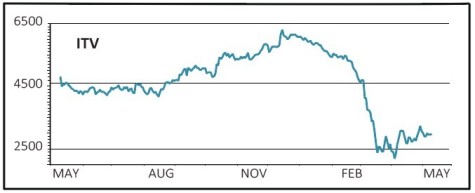

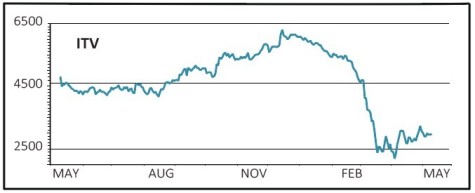

ITV (ITV) 72.6p

Loss to date: 4.5%

Free-to-air broadcaster ITV (ITV) may have lost some of the momentum gained in the wake of a first quarter trading update (6 May) but we continue to see reasons to be encouraged by the announcement.

The coronavirus pandemic both hurt demand for advertising in the first quarter of the year and continued into April with advertising down 42% for the month. Its ITV Studios production business is effectively on pause.

For the three months to 31 March, total external revenue was down 7% at £694m year-on-year, with ITV Studios’ revenue down 11% at £342m, broadcast revenue up 2% at £500m and ITV total advertising up 2% as originally guided, with online revenues up 26%.

ITV total viewing was up 2% with ‘very strong’ growth in online viewing up 75%, simulcast viewing up 112% and reach up 40% on the ITV Hub.

Its main channel’s share of viewing hit 17.9%, its best quarter since 2009, and the company flagged growth for its BritBox venture with the BBC in the form of free trial starts and subscriptions.

Shore Capital analyst Roddy Davidson says: ‘We believe that ITV should be a significant beneficiary of a recovery in advertising spend as Covid-19 lockdown measures are relaxed.’

SHARES SAYS: ITV remains an attractive way to play a rebound in advertising spend.

‹ Previous2020-05-14Next ›

magazine

magazine