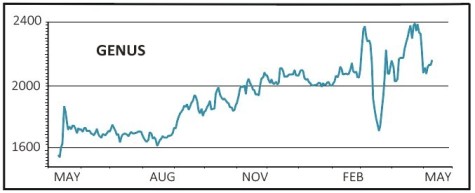

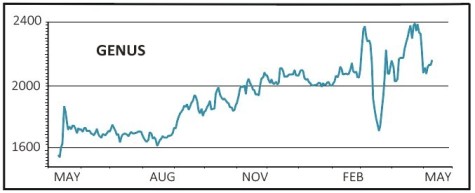

Genus (GNS) £33

Gain to Date: 16%

Our bullish take on Genus (GNS), the leading provider of animal genetics for pig, dairy and beef markets worldwide, continues to pay off and we remain positive on the investment case.

While the company will face tougher comparatives in the second half of the year including more potential disruption from coronavirus, the company has not, as yet, had to downgrade expectations for the 2020 financial year running to 30 June.

According to Refinitiv full year revenue is anticipated to be around 8% higher at £526.5m, with pre-tax profits 17.6% higher at £69.3m.

The company posted record pre-tax profits of £30.4m for the six months to 31 December 2019, around 20% better than analysts at broker Liberum had expected.

The restocking of pig herds in China in response to African Swine Fever helped to propel Asian profits almost 300% higher. Increasing success of the innovative Sexcel product which delivers more pregnancies and allows more flexible farming of dairy herds saw volumes expand by 56%.

The company’s beef genetics programme continues to produce superior growth, efficiency and yield, justifying past strategic investments.

SHARES SAYS: Genus is a quality business that remains well placed to benefit from its strong competitive positioning and we remain buyers.

‹ Previous2020-05-14Next ›

magazine

magazine