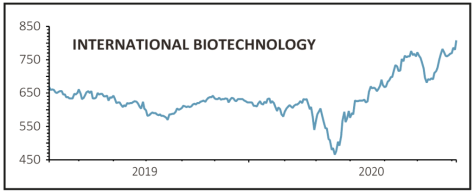

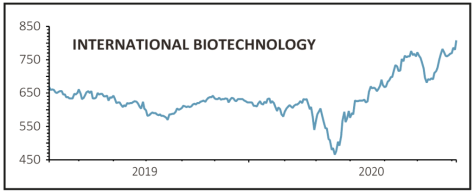

International Biotechnology Trust (IBT) 793p

Gain to Date: 73.5%

Original entry point: Buy at 457p, 19 March 2020

Napoleon supposedly preferred lucky generals to good ones, and while our timing to buy International Biotechnology Trust (IBT) was lucky, coming as it did a few days before equity markets bottomed, it also demonstrated the sense in buying quality assets managed by an experienced team at a then-18.5% discount.

The price discount to net asset value has since narrowed to 1.8%, providing a good uplift to the share price performance. In addition, the portfolio has also strongly outperformed the 38% return delivered by its benchmark, the Nasdaq Biotechnology index.

The fund manager’s conservative approach to raise cash earlier in the year by trimming positions where there was a heightened risk of study or filing delays, and reinvesting in areas less affected such as critical cancer treatments, has paid off handsomely.

Among its investments, Danish firm Genmab which specialises in therapeutic antibodies for treating cancers and infectious diseases has doubled in value since March, and rare diseases specialist Horizon Therapeutics has seen its share price more than double over the same period to become the trust’s largest holding at 6%.

SHARES SAYS: Covid-19 has accelerated global research and innovation efforts to find new drugs and International Biotechnology Trust remains a conservative way to gain exposure to this sustainable trend. Buy.

‹ Previous2020-07-09Next ›

magazine

magazine