magazine 16 Jul 2020

Download PDF Page flip version

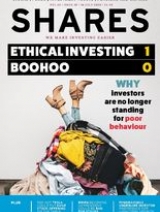

Ethical investing 1, Boohoo 0. Shares explains why investors are no longer standing for poor behaviour.

The market is mad for Tesla, so is this the perfect time for the company to raise billions of dollars and wipe out its debt?

Discover the great misconception about investment trust revenue reserves and find out how temporary stamp duty relief could benefit home buyers in different parts of the country.

This week’s investment ideas include a ‘best in class’ healthcare services business and a care home investor yielding 6%.

Learn why Joe Biden winning the US presidential election could be bad for stocks and how moving overseas could impact your pension.

Stock and sector-specific factors will have a big impact on results

We offer some pointers as to where you should look for information to support investment decisions

Debt could be wiped out leaving it stronger financially

It provides a quick overview of which investments are increasing or decreasing portfolio diversification

Post-Covid, investors seem more concerned with short-term profits than long-term growth

Already stretched company balance sheets face record levels of fresh borrowing

We explain how the professionals set prices at which they will buy and sell shares

But an impressive dividend growth track record is preserved for now

Will the variety goods retailer continue to outperform now lockdown is easing?

Significant redundancies are being announced by employers in the wake of coronavirus

Firms with strong franchises have been the most successful in raising capital

They are not ringfenced pots of cash, contrary to popular belief

The maximum saving under the new scheme is £15,000 for someone buying a property worth £500,000 or more

It could lead to higher taxes, fewer share buybacks and lower corporate profits

Car supermarket motors on news of an encouraging post-lockdown restart

Faster than expected Covid recovery puts dividends back in play and sends stock soaring

The outsourcing expert is fighting fit to grab market share while rivals struggle

A rapid response to lockdown helped maintain balance sheet strength and position the business for further growth

A focus on quality assets with single occupancy rooms and en-suite facilities should serve it well

The investment trust's latest fundraising was oversubscribed as investors seek new sources of income

Don't let its loss-making position put you off owning the shares

Our resident pensions expert explains how the QROPS scheme works