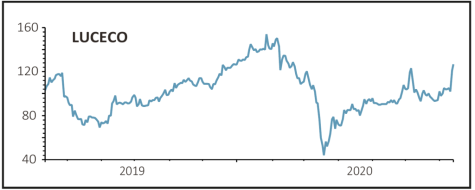

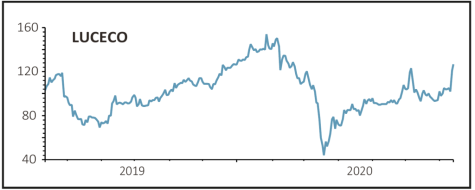

LUCECO (LUCE) 128p

Gain to date: 10.3%

Original entry point: Buy at 116p, 19 December 2019

Broker Numis has upwardly revised its forecasts for Luceco (LUCE) for the second time in barely a month after the LED lighting and portable power products maker said that trading was materially ahead of current analyst expectations.

Luceco said adjusted operating profit would at least equal its 2019 performance of £18 million, sending shares in the business soaring more than 25%. It also expects to restart dividends for the first half of the current financial year, having axed the second half 2019 payout.

Numis analyst Kevin Fogerty has recalculated his full year to December 2020 estimates to reflect the strength of current trading momentum, having done similarly in early June.

His adjusted operating profit estimate has been lifted by 16.5% from £16.9 million to £19.7 million. That’s just £0.8 million shy of his £20.5 million 2020 forecast pencilled in before the Covid-19 outbreak, illustrating how Luceco has quickly bounced back from coronavirus-related business disruption.

‘Our current year adjusted earnings per share (EPS) forecast increases by 23% to 9p,’ the analyst confirmed. His pre-Covid EPS estimate stood at 8.9p. Forecasts for 2021 were also raised around 13%.

SHARES SAYS: Management has done an exceptional job during the pandemic and we are confident in the shares’ scope for further gains.

‹ Previous2020-07-16Next ›

magazine

magazine