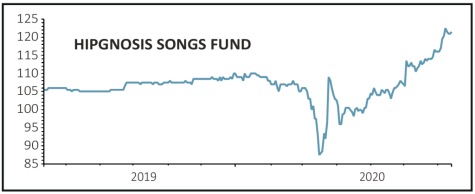

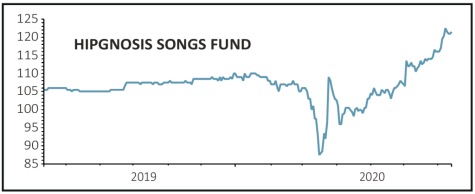

Hipgnosis Songs Fund (SONG) 121.5p

Gain to date: 5.2%

Original entry point: Buy at 115.5p, 18 June 2020

Better than expected demand for investment trust Hipgnosis Songs Fund’s (SONG) equity placing has seen it raise £236.4 million by issuing new stock at 100p per share. Of that amount, £3 million came from retail investors.

Hipgnosis originally set out to raise £200 million to buy more song catalogues. It makes money from royalty payments and has a £1 billion pipeline of potential acquisitions.

The new shares will trade separately to the existing ones until one month after a minimum 80% of the new money is deployed or the close of business on 15 July 2021, whichever is earliest.

Investors in these ‘C’ class shares will qualify for dividends from any income generated from investments using the new cash.

The C shares will eventually be converted into ordinary shares and so anyone owning the C shares will then benefit from having exposure to a much broader catalogue of royalty-generating songs.

Hipgnosis wants shareholders to vote at the September AGM on changing the conversion date so that it is linked to the semi-annual net asset value calculation. Under the proposed changes, the latest calculation date would be 30 September 2021 and the latest conversion date would be 28 February 2022.

SHARES SAYS: Hipgnosis now has a large chunk of cash to buy songs and increase their value through film, advert and TV placements. Buy the ordinary shares, not the C ones.

‹ Previous2020-07-16Next ›

magazine

magazine