The resilience of the UK housing market has been one of the notable features as we moved out of lockdown and into the next phase of the pandemic.

This was reflected in recent first half results from property site Rightmove (RMV) which saw the company reveal that between the beginning of June and end of July demand for sales properties was 50% higher than the same period in 2019.

In lockdown there were predictions that estate agents would act on grumbles over Rightmove’s increasing level of fees and use a period when the market was effectively in hibernation to leave the platform.

However, membership numbers for agency branches and new home developments combined were down just 3.3% since the start of 2020 to 19,158.

It seems rather than driving agents away, a period of housing market volatility may have reinforced the network effect which has helped underpin the company’s impressive growth over the last decade or more.

Because the site has the most listings, it is therefore the one which prospective property buyers will go to when looking for their next home. This reinforces its position as a must-have product for estate agencies and gives it significant pricing power when it comes to securing subscriptions from agencies.

Agents are arguably more reliant than ever on Rightmove’s services and reach as they have to sell properties to stay afloat.

However, it will be interesting to see if this holds true if or when Rightmove looks to return to a pre-Covid pricing structure having offered discounts through the crisis.

Currently discounting has been extended until the end of September – although that month will see a reduction of just 40% compared with 75% when lockdown was at its height.

The foundations of the housing market may also come under pressure this autumn, assuming the furlough scheme comes to an end as planned in October.

This could lead to a material increase in levels of unemployment, which is likely to have a negative impact on demand for homes.

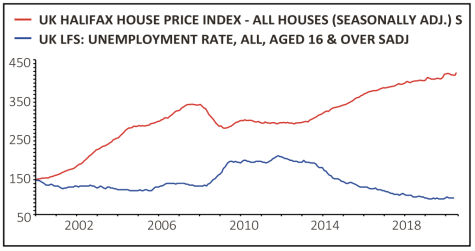

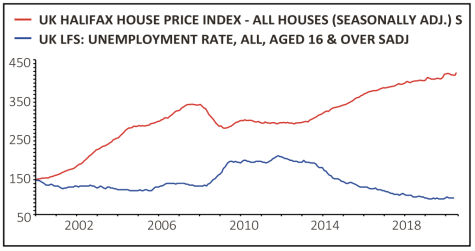

A look at house prices and unemployment over the last 20 years unsurprisingly indicates a significant negative correlation with house prices falling as unemployment rises and vice versa.

‹ Previous2020-08-13Next ›

magazine

magazine