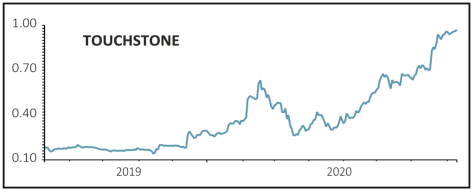

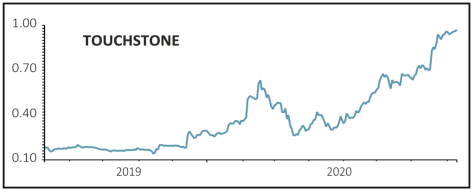

Touchstone Exploration (TXP:AIM) 73p

Gain to date: 40.4%

Original entry point: Buy at 52p, 25 June 2020

Our positive call on Trinidad oil firm Touchstone Exploration (TXP:AIM) has performed strongly with the main catalyst being an updated reserves report on its Cascadura natural gas discovery (20 Jul).

The independent report on Cascadura identified proved and probable (2P) reserves net to Touchstone of 45 million barrels of oil equivalent, which was larger than most analysts’ forecasts.

The independent report on Cascadura identified proved and probable (2P) reserves net to Touchstone of 45 million barrels of oil equivalent, which was larger than most analysts’ forecasts.

As Canaccord Genuity’s Charlie Sharp commented: ‘The Cascadura reserves report confirms 2P reserves 29% higher than we had previously modelled.

‘The reserves report is another significant moment for Touchstone, demonstrating the value of successful and meaningful exploration, in a location where it anticipates rapid conversion to cashflow generation following a low cost development programme operated by the company.’

Sharp expects peak production from Cascadura alone to be more than 10 times the current output of around 1,500 barrels of oil equivalent per day, with first output anticipated mid-2021.

And with an agreement on gas sales and more drilling on another exploration well, Chinook, expected imminently there is plenty of news flow to help underpin the momentum behind the stock.

SHARES SAYS: We remain excited about the potential here as production looks set to increase substantially in the next 12 months or so.

‹ Previous2020-08-13Next ›

magazine

magazine The independent report on Cascadura identified proved and probable (2P) reserves net to Touchstone of 45 million barrels of oil equivalent, which was larger than most analysts’ forecasts.

The independent report on Cascadura identified proved and probable (2P) reserves net to Touchstone of 45 million barrels of oil equivalent, which was larger than most analysts’ forecasts.