As investors flock to gold amid a wall of worries, one exchange-traded fund (ETF) has seen so a high level of inflows it now holds more gold than central banks including the Bank of England and Bank of Japan.

SDPR Gold Shares, run by American ETF giant State Street, now has $80 billion of investors’ money and owns 1,258 tonnes of gold, more than four times of that held by the BoE and almost double that held by the BoJ.

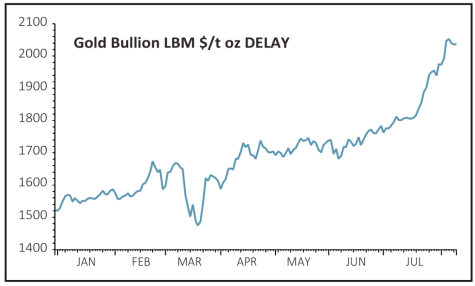

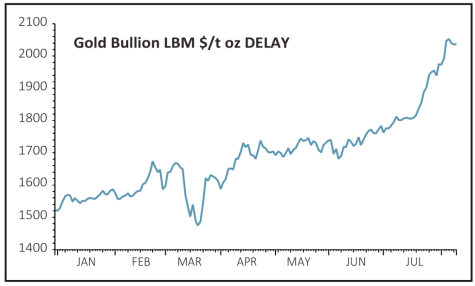

It comes as the price of gold topped $2,000 an ounce, with the shiny metal’s momentum currently showing little signs of slowing down.

The SPDR ETF is one of the cheapest on the market with an annual charge of 0.1% a year, and its success comes as other ETF providers try to lower their costs to entice investors lured by the gold rush.

Invesco Physical Gold ETC (SGLD), for example, this week reduced its fee from 0.19% to 0.15%, making it the cheapest available to UK investors when combined with its bid-offer spread, as it continues to tap in to investor demand.

But the rapid rise of both the gold price and gold ETF inflows has some questioning whether it’s the high level of investor money being put into gold ETFs which is actually driving up the price so much.

Gold-backed ETFs saw an eighth consecutive month of inflows in July according to the World Gold Council, with just two ETFs, SPDR Gold Shares and iShares Gold Trust representing 61% of all global inflows.

A study by Campbell Harvey, professor of finance at Duke University and senior adviser at Research Affiliates, showed that as the two largest gold ETFs grew in assets between 2004 and 2020, so did the real price of gold.

The study found the average buyer of gold ETFs drives up the price of gold and a seller on average drives it down, suggesting a significant correlation between the real price of gold and the holdings in gold ETFs.

Harvey said, ‘The ETF financialisation of gold ownership, in which the real price of gold may be correlated with the amount of gold held by gold-owning ETFs, could possibly lead to higher peaks and lower troughs for the real price of gold relative to the experience of the past.’

He added that ‘passive massives’, referring mostly to the aforementioned SPDR and iShares ETFs, appear to have created gold demand-pull inflation, driving the price up further.

‹ Previous2020-08-13Next ›

magazine

magazine