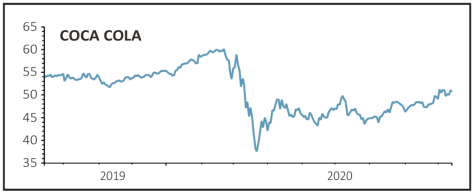

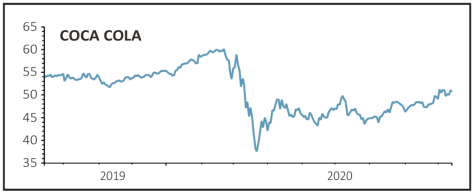

THE COCA-COLA COMPANY (KO:NYSE) $51

Gain to date: 5.2%

Original entry point: Buy at $48.48, 30 July 2020

Our recent ‘buy’ call on beverages behemoth The Coca-Cola Company (KO:NYSE) is a decent 5.2% in the money and we are staying positive on the business behind the world’s most recognisable soft drink.

James Quincey-led Coca-Cola’s shares have risen since the company announced (28 Aug) a major workforce restructuring plan involving voluntary and involuntary layoffs for employees in the US, Canada and Puerto Rico – Coca-Cola said a similar programme will be offered in many countries internationally.

In addition, nine new operating units will replace 17 business units as the company focuses on cutting costs and scaling new products faster.

Although Coca-Cola’s overall global severance programmes are expected to cost the soft drinks colossus $350 million to $550 million, the market welcomed the focus on slashing costs and becoming a leaner organisation.

While there is no end in sight to the pandemic, we continue to like Coca-Cola as a recovery play. The consumer defensive colossus has proven pedigree in surviving challenging periods and emerging stronger over the long term.

It has also proved a market-beating investment with dividends forming an important part of total returns.

SHARES SAYS: Keep buying.

‹ Previous2020-09-17Next ›

magazine

magazine