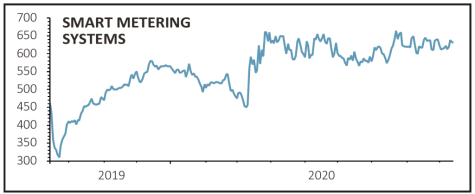

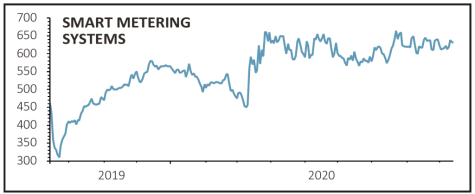

Smart Metering Systems (SMS:AIM) 660p

Gain to date: 40.4%

Original entry point: Buy at 470p, 24 October 2019

Despite what is a very uncertain period for companies amid all the economic turmoil from the coronavirus pandemic, smart meter installer Smart Metering Systems (SMS:AIM) has continued to show its resilience to wider shocks.

On a reported basis the company swung from a £1.7 million loss in the first-half last year to a £194.4 million pre-tax profit.

This was helped by the £291 million sale of a minority of its meter assets, which also wiped out debt. The company now has £44.5 million in net cash on its balance sheet.

It plans a 25p per share final dividend which will increase at a fixed rate of 10% a year to 2024.

Chief executive Alan Foy told Shares the dividend is underpinned by cash from existing assets and adds that ‘we’re not reliant on any growth in our business at all to pay the dividend’.

SMS also revealed it is looking at battery storage as a key growth area after the smart meter rollout is complete, having secured a strong and growing pipeline of grid-scale projects.

Foy says: ‘We’re really excited about battery storage. It will be many times the size of smart meters and we see that as a real, tangible, viable business opportunity beyond smart meters.’

SHARES SAYS: Hold on to the stock for the income stream.

‹ Previous2020-09-17Next ›

magazine

magazine