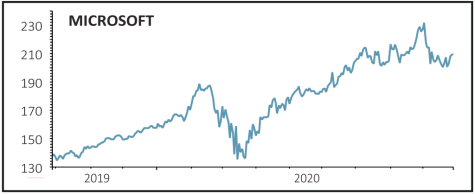

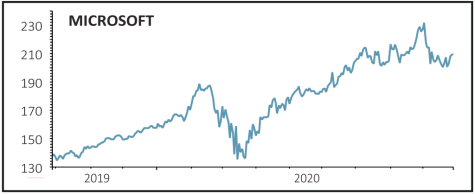

Microsoft (MSFT:NDQ) $209.54

Gain to date: 21.3%

Original entry point: Buy at $165, 9 April 2020

Microsoft is paying $7.5 billion for video game company ZeniMax, in a move which strengthens its position in the increasingly competitive – and lucrative – cloud gaming sector.

ZeniMax makes online multiplayer franchises which importantly for Microsoft are subscription-based games where users pay a monthly fee to play.

It’s estimated such cloud-based gaming models could become more popular than discs and consoles in the next five years, as people subscribe to games instead of buying them and which are played on any device with an internet connection.

Microsoft also foresees gaming very quickly heading towards the direction of film and TV where box office hits and original content drive revenue, making its acquisition of a gaming studio with proven hits look like a very shrewd move.

Gaming made up 7.7% of Microsoft’s revenues in 2019 and is an important area for the company. Chief executive Satya Nadella sees gaming as a high growth sector and calls it the ‘most expansive category in the entertainment industry’.

Consoles like its Xbox machine have a lifespan of around five to 10 years, which means its gaming sales can dip between the release of new versions.

Adding ZeniMax to the mix and its popular titles like Elder Scrolls and Fallout also means Microsoft can potentially plug the gap in sales over the short-term, while benefitting longer-term from structural change in the sector.

SHARES SAYS: Keep buying.

‹ Previous2020-10-01Next ›

magazine

magazine