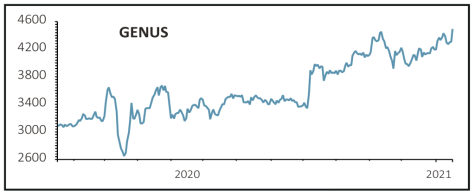

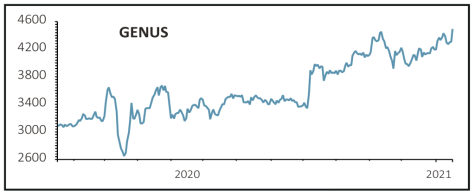

Genus (GNS) £45.64

Gain to date: 60.4%

Original entry point: Buy at £28.46, 19 September 2019

Shares in animal genetics company Genus (GNS) reached an all-time high this week after the company upped guidance for full year growth.

Commenting on trading for the six months to 31 December 2020, Genus said it expected adjusted pre-tax profit in actual currency to be between £47 million and £49 million compared with £36.6 million in the previous year.

Revenues are expected to be in the £285 million to £287 million range, up 5% from the £270.7 million achieved in 2019. Strong trading in the pig genetics business in China continued as farmers rebuilt pig herds after the impact from African Swine fever. In addition, bovine genetics showed strength across Brazil, Russia, India and China.

While the board expects some slowdown in the second half, the momentum already gained will result in higher growth than previously expected for the year to 30 June 2021.

SHARES SAYS: The current consensus analyst estimate for full year pre-tax profit is £79.2 million on revenues of £592 million according to data provided by Refinitiv, implying upward pressure on estimates once analysts incorporate the latest update. The stock remains a ‘buy’.

‹ Previous2021-01-21Next ›

magazine

magazine