Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

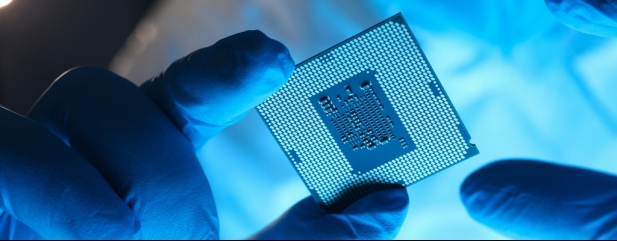

Semiconductor cycle is turning to Micron’s advantage

This complex memory microchip manufacturer is a good illustration that not all quality technology businesses trade on sky-high valuations. NASDAQ-listed Micron Technology is one of the world’s top producers of DRAM (dynamic random access memory) and NAND flash memory chips.

DRAM is used in PCs, laptops, smartphones and servers to perform their various functions. NAND flash is what allows a memory stick to work, or you to store music on your phone.

A year ago, Micron was struggling, pushing against supply gluts and declining prices, as happens from time to time in this notoriously cyclical semiconductor industry. Then Covid came. But as with many tech stocks, what started as a headwind ended up creating an ideal environment in which the company could thrive.

Supply chains were disrupted by the pandemic, and the demand for memory chips in data centres and computers increased at the same time. This saw Micron’s share price double since August, but we anticipate the rally will continue through 2021 as chip supply and pricing dynamics continue to improve.

Many analysts agree. ‘Our industry checks indicate lean DRAM channel inventory, and we expect contract prices to improve sequentially into the February and May quarters,’ said Summit Insights earlier this month.

Summit analysts also believe that NAND prices have now hit rock-bottom with recovery drivers coming from innovations in augmented and virtual reality, bendable smartphones and 5G adoption. 5G goes beyond smartphones, touching themes like internet of things connectivity, data centres and increased volumes of electronics in cars, not least electric vehicles.

As a result, the chipmaker’s results improved consistently throughout last year and it ended fiscal 2020 (to 31 August) on a solid note given the disruption caused by the pandemic.

The good news for investors is that Micron is widely expected to sharply improve its financial performance this year, and into fiscal 2022, as evident from its recent results that led to a spate of analyst upgrades.

First quarter numbers published in January 2021 showed a 12% revenue rise to $5.77 billion, comfortably beating consensus estimates of $5.66 billion. Earnings per share (EPS) jumped from $0.48 to $0.78 year-on-year, again beating the $0.69 forecast.

There remained nods to caution in the statement, although that may imply potential to repeatedly outstrip expectations as the year progresses. As the business backcloth continues to improve, so earnings recovery should accelerate. EPS is expected to increase 45% this year, then almost double in 2022 to $7.93.

That would slash the already reasonable valuation, or send

the stock shooting higher. At the current $80.72, the 2021 price to earnings multiple stands at 19.6, falling to 10.2 the year after.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

First-time Investor

Great Ideas

- Experian reports reassuring growth

- Semiconductor cycle is turning to Micron’s advantage

- Polar Capital shares remain cheap despite high quality status

- Genus shares hit new record high after upgrading guidance again

- Knockout performance from Baillie Gifford US Growth

- Buy into Disney’s long-term dominance of the entertainment sector

Money Matters

News

- Major breakthrough for Netflix as it aims to be self-sustaining

- Three small cap new issues are currently flying high

- Investors buying IAG shares will have to pay new Spanish tax

- Shares in McDonald’s stall as challenges mount

- Shares in cruise operators start to rise as potential early vaccine beneficiaries

- High hopes for Bahamas Petroleum exploration well

magazine

magazine