Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Investing in future trends while avoiding the crowd

The events of 2020 have given us a clue as to where the world is headed, such as more time spent working from home and wider use of technology to do business. It was easy to spot those trends, and shares in relevant companies have already been bid up to high levels as the market prices in likely future success.

You could argue these are now crowded trades, and so anyone buying today is going to struggle to make decent returns when so much good news is already discounted into a stock’s valuation. This can be frustrating, particularly as investors are often told to look to the future to help shape decisions.

However, there is still merit in using themes to narrow down where to find opportunities. The market isn’t always right in terms of pricing in likely future success, and you can still find underappreciated companies which play into a strong theme.

WHERE TO START

One hunting ground is to look at companies helping the ‘obvious’ winners to succeed. It’s a bit like the Californian gold rush of the 1840s and 1850s – the picks and shovel sellers made more money than those who eventually discovered gold.

Asset manager Lazard has proved to be good at tapping into investment themes, being early to spot the potential of certain companies and knowing when to take profits when certain parts of the market are looking crowded.

UK investors can access its expertise through investment funds Lazard Global Thematic Focus (BKX9F08) and Lazard Global Thematic (B464177), the former being a best ideas version of the latter.

SELECTIVE APPROACH

Part of its approach is to look for what it calls ‘second order effects’ of themes, essentially the companies providing the picks and shovels to support certain themes. For example, it is confident that digitisation of systems is a strong structural growth theme across many industries, but which stocks to buy?

While any semiconductor company would seem like an obvious beneficiary, the industry faces the threat of China aiming to make 70% of its own semiconductors by 2025 and there is also the potential for big Western users to make their own components. Therefore, it doesn’t pay to buy just anything from this sector.

Lazard prefers to look at parts of the supply chain that provide essential components and which can push up prices without affecting demand for their products.

‘You’ve just had a lot of auto companies saying they wouldn’t be able to produce as many vehicles as they want in the first quarter of 2021 because of a shortage of semiconductors,’ says Steve Wreford, a portfolio manager in Lazard’s global thematic equity team. ‘These are the mission critical components. The impact of a shortage is pricing power.’

Infineon is among the semiconductor names in the Lazard Global Thematic Focus portfolio and its share price is up 62% over the past 12 months, with the rally having been sustained since the market low

in March 2020.

Off to an impressive start

From launch on 5 February 2020 to 14 January 2021, Lazard Global Thematic Focus has returned 25.4% in US dollar terms versus 17.2% from the MSCI ACWI benchmark, according to FE Fundinfo.

SOME THEMES ARE ‘PASSÉ’

In contrast, some of the stocks which investors perceive to be part of structural growth themes have struggled to sustain positive share price momentum in recent months.

For example, Zoom Technologies – which is not in the Lazard portfolio – initially saw its stock rally when people realised the benefits of using web-based conference systems in lockdown and how it could be a long-term beneficiary of more people working from home.

However, Zoom’s shares have fallen by more than a third since October as investors took a more sceptical view that the video conferencing had no barriers to entry and commanded little customer loyalty, plus the vaccine roll-out could see demand decline for web calls.

‘The idea that 2020 has accelerated structural change is passé – it is well known now, and fully discounted. We actively try to avoid what’s discounted in the market. I think everyone knows we will work from home more now,’ says Wreford. ‘It’s all about facing forward.’

LASTING APPEAL

The fund is interested in companies which will provide services that will be in demand for many years to come, rather than something that is in favour now but might wane over time. Autodesk and PTC are in its portfolio precisely for this reason.

Autodesk makes architectural software and Wreford says it is learned in college and people in the property/construction industry will probably use it for the rest of their career. ‘PTC makes industrial design software, which takes a long time to learn and it will be in place for a very long time,’ he adds.

Wreford says these stocks underperformed for a few months in 2020 on initial concerns there would be fewer buildings going up and less industrial activity, therefore less need for licences. He argues the opposite will happen. ‘They are establishing themselves as the industry standard for the next generation of architects and designers.’

ANOTHER MISUNDERSTOOD COMPANY

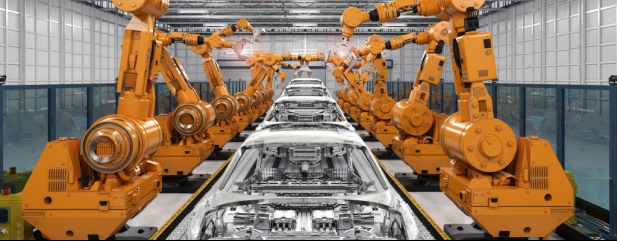

Another company that has been misunderstood, in Wreford’s view, is Johnson Controls even though the shares have doubled in price since the March 2020 lows. It taps in to one of Lazard’s favourite themes, namely ‘asset efficiency’ which is the rise of industrial operating systems that make physical assets smarter such as managing air conditioning and energy usage or making factory robots learn from each other.

‘Johnson Controls has a building operating system and is off the radar because buildings are dull,’ says the portfolio manager. ‘It is are now applying artificial intelligence technology to monitor all the data and automate how energy efficiency is improved. The company is perceived to be a value stock because people think it is just a traditional building company.’

NEW HYBRID WORLD

Wreford is also a fan of companies which have been forward thinking, allowing themselves to adapt during the pandemic and be beneficiaries when society reopens. Names fitting this theme in its portfolio include retailer Inditex. ‘It’s done a great job and spent about eight years making sure all of its inventory was tagged with RFID which means Inditex knows exactly where all of its inventory is around the world at any one time.

‘That enabled it to turn every Zara store into a distribution centre when the pandemic hit. Inditex will sell more when people can return to stores and see and feel the clothes.’

Wreford says Inditex is still trading at a reasonable valuation – 26 times the next 12 months’ forecast earnings – because people are still worried about new strains of coronavirus which might affect near-term trading.

CONTRARIAN VIEW

There is clear willingness to go against the crowd if the long-term opportunity outweighs any short-term issues. A good example is the fund owning a stake in Chinese e-commerce giant Alibaba. The portfolio says the stock has already been ‘crushed’ because of being a large shareholder in Ant Financial which has come under regulatory scrutiny in China, as well big tech being under scrutiny.

However, it plays well to the ‘empowered consumer’ theme in Lazard’s portfolio. ‘It trades on a mid-teens PE (price to earnings) ratio a couple of years out – an astonishingly inexpensive valuation for a company that has a reasonable chance of growing its revenues north of 20%,’ says Wreford.

‘The general rule that we’ve found as long-term investors is that it pays to buy uncertainty. The flipside is that when an idea becomes widely known like working from home accelerating, there are no incremental buyers left so it is a good time to recycle capital elsewhere.

‘With Alibaba, the regulatory risk is real but based on what we know now we feel you are probably paid to take it.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

First-time Investor

Great Ideas

- Experian reports reassuring growth

- Semiconductor cycle is turning to Micron’s advantage

- Polar Capital shares remain cheap despite high quality status

- Genus shares hit new record high after upgrading guidance again

- Knockout performance from Baillie Gifford US Growth

- Buy into Disney’s long-term dominance of the entertainment sector

Money Matters

News

- Major breakthrough for Netflix as it aims to be self-sustaining

- Three small cap new issues are currently flying high

- Investors buying IAG shares will have to pay new Spanish tax

- Shares in McDonald’s stall as challenges mount

- Shares in cruise operators start to rise as potential early vaccine beneficiaries

- High hopes for Bahamas Petroleum exploration well

magazine

magazine