Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Global chip shortage threatens industrial growth forecasts

An unusual and unexpected side effect of the pandemic has been the strain on the global supply chain in manufacturing as products and parts made in far-clung parts of the world have been delayed reaching customers.

Added to this, a shortage of containers has sent freight rates sky high so not only are manufacturers facing shortages of parts but their input prices are rising sharply as well.

A growing number of UK firms are referencing increased costs in their first quarter trading updates with the warning that they are likely to face more of the same this quarter.

In Germany, the latest Ifo survey of business confidence for the next six months missed expectations due to a mixture of concerns over coronavirus and supply constraints.

A record 45% of manufacturing firms reported supply chain shortages, the highest level in 30 years. Ifo president Clemens Faust referred to the squeeze as ‘a serious problem’ which could hold back the economic recovery.

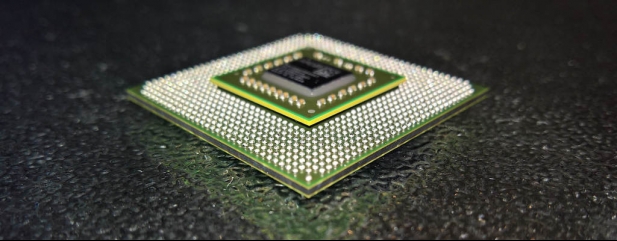

CHIPS WITH EVERYTHING

One of the biggest issues is a global shortage of computer chips, as some Asian firms slowed down or even stopped production at the start of the pandemic.

Meanwhile, the trend towards remote working has driven up demand for home PCs and laptops, and at the same time car makers have been increasing production of electric vehicles, which use several times more chips than normal vehicles.

Carmakers around the world have had to slow production in the last few weeks, with Jaguar Land Rover, Jeep and Mitsubishi idling plants or putting workers on short-term hours and laying off temporary staff as the try to deal with the shortage.

German giant Volkswagen recently warned there would be ‘considerable challenges’ in meeting its production targets this quarter. It has already had to cut manufacturing by 100,000 vehicles and is unlikely to be able to make up the lost output this year, according to chief executive Hubert Diess.

Mike Jackson, chief executive of Autonation, one of the largest car dealerships in the US, says he sees ‘no end to the chip shortage this year’, meaning deliveries of new car sales will fall short. Autonation has already had to fall back on used car sales to meet demand.

One firm which could benefit from the squeeze is Dutch semiconductor equipment maker ASML. The firm is a world leader in chip-making machines, and is a key supplier to big manufacturers like Nvidia, Samsung and TSMC.

Last week the firm raised its full year sales growth forecast from between 10% and 15% to around 30% due to increased demand for its machines, sending its share price to a new high of €550.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

- Help, I want to start saving for the future

- Rising prices: The investments to benefit from a higher cost of living

- Why value shares win when interest rates rise

- Ongoing uncertainty for commercial property stocks

- Emerging markets: Views from the experts

- Understanding China’s dominant but under pressure internet stars

Great Ideas

- Focusrite is up 75% in the last nine months

- Big upgrades for Morgan Sindall on bullish trading update

- Anglo American is an attractive play on electric vehicle and renewables transition

- Exit Anexo which has gone nowhere on positive news

- Buy payments challenger Equals as it passes the 2020 test

- RWS merger continues to pay off in spades

magazine

magazine