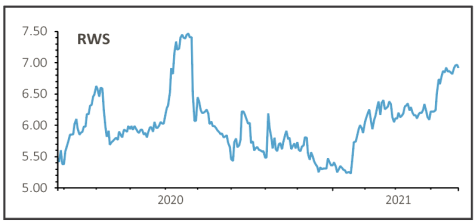

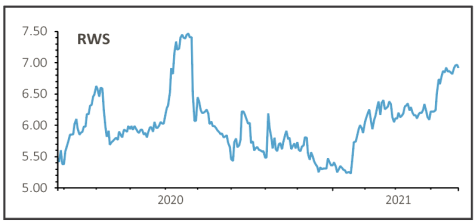

RWS (RWS:AIM) 696p

Gain to date: 30.3%

Original entry point: Buy at 534p, 23 December 2020

Leading language services and technology group RWS (RWS:AIM) reported good progress on the integration of SDL at the interims (22 April), saying it had identified over £32 million annual cost synergies, more than double those initially stated at the time of the acquisition.

Plans are in place to deliver £13.2 million of those savings in the current financial year by removing overlapping costs.

In the first-half the company generated revenues of £326.4 million compared with £169.7 million in the prior year, in line with expectations.

The group expects to report adjusted pre-tax profit of at least £50 million in the first half compared with £31.1 million, ahead of its expectations.

Growth was achieved across all four of the recently formed divisions with the Regulated Industries segment achieving double digit revenue growth in constant currencies, driven by strong growth to the group’s largest pharmaceutical business.

Analysts have been steadily increasing their earnings estimates since the start of the year according to data provided by Refinitiv.

SHARES SAYS: The company’s habit of overdelivering against conservatively set goals, and the current momentum within the business should be positive for the shares.

‹ Previous2021-04-29Next ›

magazine

magazine