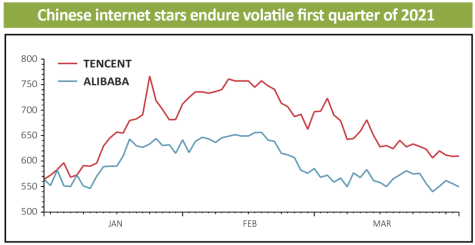

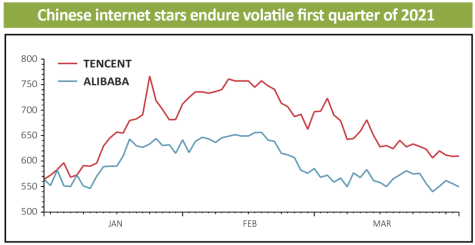

After a strong start to 2021 Chinese internet businesses including Alibaba and Tencent saw their share prices come under mounting duress on a mix of heightened regulation and dampened sentiment towards the wider technology sector.

Alibaba has been hit by a $2.8 billion anti-trust fine amid increased regulatory pressure domestically, while in the US the Securities and Exchange Commission is requiring Chinese stocks with a US listing to meet stricter criteria.

Yet these companies still dominate the Chinese equity markets. The collective weighting of Tencent and Alibaba along with their smaller counterparts Meituan, JD.com and Baidu in the MSCI China index was more than 35% as at the end of March 2021.

Given this dominance it is worth having some idea of what each of these businesses do in a little more detail.

Alibaba – China’s answer to Amazon – with a big footprint in online shopping and dominant position in cloud computing.

Tencent – owns hugely popular web portals, messaging and social media apps as well having a substantial presence in the video games market.

Meituan – online shopping platform which focuses on locally sourced consumer products and services as well as hosting customer reviews and offering Groupon-style discounts.

JD.com – China’s second largest e-commerce business with a burgeoning logistics arm, which opened up its services to third parties in 2017 and is subject to a proposed spin-off.

Baidu essentially a Chinese Google – alongside search engine services it specialises in areas such as online advertising and artificial intelligence.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here

‹ Previous2021-04-29Next ›

magazine

magazine