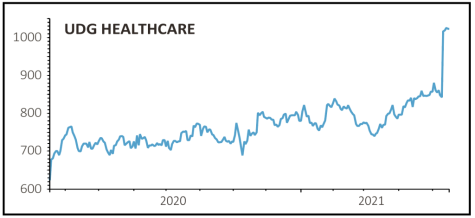

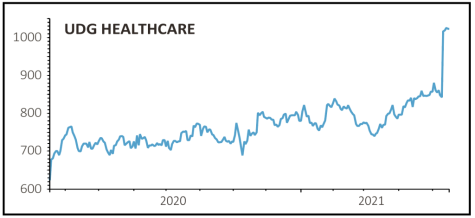

UDG Healthcare (UDG) £10.23

Gain to date: 47.4%

Original entry point: Buy at 694p, 16 July 2020

It seems that others have noted the value we saw in health-related services business UDG Healthcare (UDG) in July 2020 as the board has now recommended a £10.23 per share cash offer from US private equity firm Clayton, Dubilier & Rice.

The bid represents a 30.3% premium to the volume-weighted average price of 785.3p over the past six months to 11 May.

The transaction values UDG at an implied enterprise value to EBITDA (earnings before interest, tax, depreciation and amortisation) ratio of 17.2 times. The implied enterprise value of £2.78 billion represents the combined value of outstanding equity and debt.

UDG’s Ashfield division, which provides advisory, communications and commercialisation services, is said to be ‘highly complementary’ with CD&R’s Huntsworth business which it purchased in 2020.

The company said the combination of the two businesses would create a ‘unique set of global solutions’ to support pharma and biotech clients across the life cycle of a drug, from development to patent expiry.

The private equity acquirer said it would invest in UDG’s Sharp division, to support its growth prospects. Sharp provides high quality outsourced contract clinical trials, manufacturing and packaging services.

SHARES SAYS: This looks to be a done deal and with the shares trading at the offer price it is worth selling now and locking in a handsome profit.

‹ Previous2021-05-20Next ›

magazine

magazine