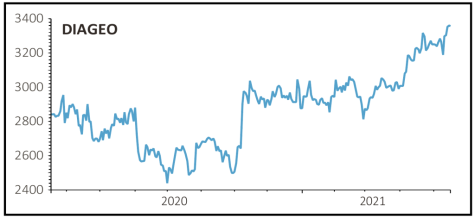

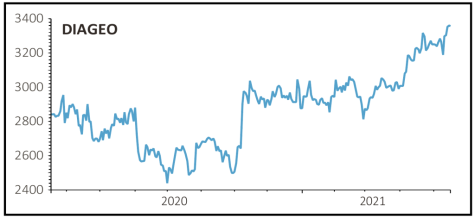

Diageo (DGE) £33.65

Gain to date: 14.3%

Original entry point: Buy at £29.45, 23 December 2020

OUR positive call on alcoholic drinks giant Diageo (DGE) is beginning to pay off, aided by an encouraging trading update on 12 May.

The company announced it was restarting a £4.5 billion capital returns programme, which originally commenced in 2019 and was interrupted by the pandemic, after continuing to see a good recovery across all regions.

This generosity to shareholders, with the company commencing the purchase of its own shares immediately, is underpinned by a forecast for organic operating profit growth to be at least 14% in the year to June 2021, slightly ahead of organic net sales growth.

Performance in North America, Diageo’s biggest market, has ‘remained particularly strong, reflecting resilient consumer demand, the breadth of our portfolio and the effectiveness of our marketing and innovation’.

In Europe, the drinks giant is benefiting from ‘strong execution’ in the retail channel and the partial reopening of bars, clubs and restaurants in certain markets.

In Africa, Asia Pacific and Latin America and the Caribbean, it is seeing ‘a continued recovery in most markets, despite the ongoing impact from Covid-19’.

SHARES SAYS: We are encouraged by this update. Keep buying.

‹ Previous2021-05-20Next ›

magazine

magazine