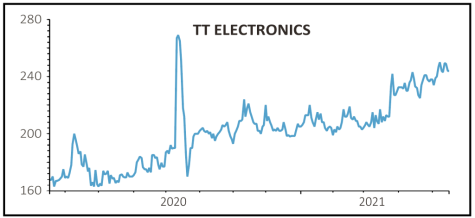

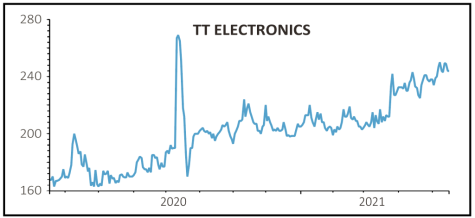

TT ELECTRONICS (TTG) 244p

Gain to date: 15.6%

Original entry point: Buy at 211p, 25 March 2021

The pace of the reopening recovery in some parts of the global economy has seen plenty of companies raise financial guidance for 2021, TT Electronics (TTG) among them.

Trading has further strengthened with organic sales ahead by 7% year-on-year in the first four months for 2021 while orders continue to run ahead of sales, presumably as customers look to lock in supply chain demand to meet their own improving prospects.

What this means for TT Electronics is that earnings before interest, tax and amortisation is anticipated to be towards the upper end of market expectations.

That range had been set at between £33.6 million and £35.4 million. Profit by the same measure in 2019, the last year before the pandemic impacted trading, totalled £44.5 million, so there’s still a way to go but analysts are increasingly confident. Consensus is for £51.3 million in 2023, which would be a record for TT.

As we explained in the original article, engineer TT is expanding beyond its traditional sensors and instrumentation markets into fast-growing, and more profitable, digital areas. This includes supplying complex connectivity, automation and machine learning components and systems for industrial, renewables and medical applications.

SHARES SAYS: A revised 2022 price to earnings multiple stands at 13.9, inexpensive given the ongoing recovery scope. Buy.

‹ Previous2021-05-20Next ›

magazine

magazine