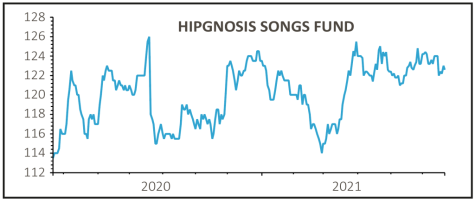

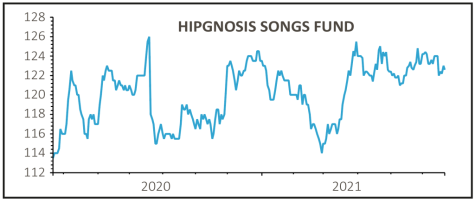

Hipgnosis Songs Fund (SONG) 122.6p

Gain to date: 6.1%

Original entry point: Buy at 115.5p, 18 June 2020

In the year since we recommended them, shares in Hipgnosis (SONG) have gained just over 6% against a 27.4% return for the benchmark FTSE 250 index.

However, in that time the market capitalisation of the firm has grown from £700m to £1.33 billion as a result of repeated capital raises to fund acquisitions of song catalogues.

The latest raise, of £150 million in new shares at 121p, is earmarked for ‘a substantial pipeline of songs that the investment advisor has identified’, which includes ‘some of the most influential and successful songs of all time’ and offers ‘substantial revenue growth opportunities’.

The firm claims that since listing it has built ‘a portfolio of songs with a value over $2.2 billion and delivered a total return NAV of 40.7% against the most challenging social and economic backdrop of our lives’.

The firm has paid 5.2p per share in dividends since last June, making for a yield of 4.5% on our purchase price and taking total returns to 10.6%, which is adequate.

SHARES SAYS: For income seekers the yield will appeal, but those in search of capital gains should look elsewhere.

‹ Previous2021-06-24Next ›

magazine

magazine