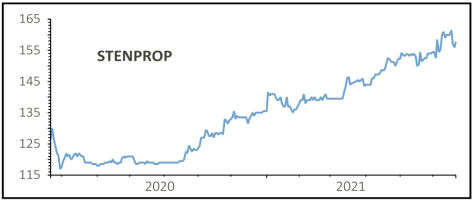

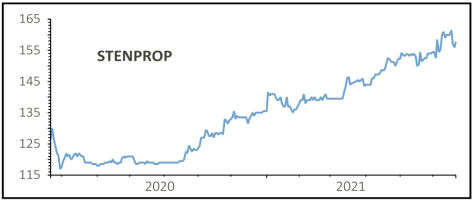

Stenprop (STP) 156.6p

Gain to date: 33.8%

Original entry point: Buy at 117p, 10 September 2020

The momentum behind multi-let industrial property investor Stenprop (STP) continues to build with recent full year results (11 Jun) revealing the company’s ongoing progress.

The company saw the value of its properties increase from £532.6 million to £582.3 million in the 12-month period to 31 March 2021, with revenue ticking up from £44.1 million to £44.9 million and the dividend maintained to deliver a full-year payout of 6.75p.

Perhaps more importantly the company confirmed it was on track to become a 100% multi-let industrial play by the end of the current financial year as it sells off non-core assets and targets £100 million in industrial acquisitions, targeting a 10% return over the medium term.

Numis commented: ‘The strong results, new dividend and total return target should be well received by the market and firmly place Stenprop as one of the most attractive real estate offerings in our peer group.

‘The fundamentals of multi-let industrial remain compelling and we believe that Stenprop has the ability to maximise returns from the sub-sector through its unique operating platform approach.’

SHARES SAYS: While the shares have rallied strongly we still have a buy rating on them.

‹ Previous2021-06-24Next ›

magazine

magazine