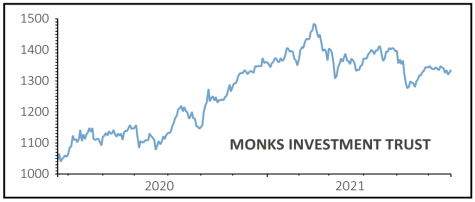

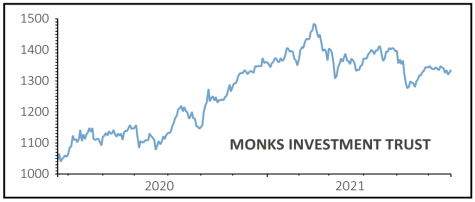

MONKS INVESTMENT TRUST (MNKS) £13.52

Gain to date: 2.9%

Original entry point: £13.14, 10 December 2020

We were expecting more than a 2.9% share price gain when adding Baillie Gifford-managed Monks (MNKS) to our Great Ideas selections list in December, but the recent renaissance of value stocks created headwinds for a trust focused on companies with above-average earnings growth.

Having consistently traded at a premium to net asset value over the past five years, Monks now trades at a 3% discount that offers an attractive new entry point.

Shares is pleased to see the trust smashed its FTSE World benchmark in the year to 30 April 2021, delivering a total return of 55.5% compared to 33.9% for the index.

Reaffirming its ‘buy’ rating, Investec Securities insists Monks gives investors ‘a differentiated and actively managed exposure to global growth’ and highlights the portfolio’s ‘rotation towards Rapid Growth companies from Cyclical Growth in recent years’, while also noting the ongoing charge is now ‘a frugal 43 basis points’.

We share Investec’s expectation that Monks’ growth philosophy and proven investment process should ‘underpin superior returns over the long term’.

SHARES SAYS: Keep buying Monks Investment Trust.

‹ Previous2021-06-24Next ›

magazine

magazine