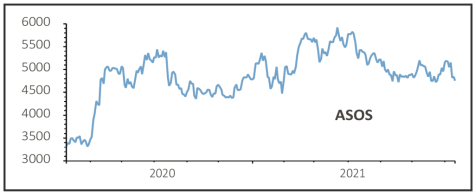

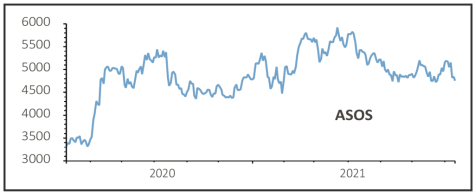

ASOS (ASC:AIM) £47.55

Loss to date: 2.5%

Original entry point: Buy at £48.79, 28 January 2021

Scheduled to issue its third quarter update as Shares went to press, on 12 July ASOS (ASC:AIM) announced a joint venture with US-based retailer Nordstrom designed to accelerate the growth of the ASOS and Topshop brands across the pond.

The first US retailer to offer the Topshop brand to the US market as far back as 2012, Nordstrom will invest for a minority interest in the brands ASOS acquired from the ashes of Arcadia – Topshop, Topman, Miss Selfridge and HIIT.

The joint venture will leverage Nordstrom’s brick and mortar presence in the US with the launch of selected ASOS brands on Nordstrom.com and in ‘high-impact’ stores. A click and collect service will be rolled out across all stores.

One dissenting voice is broker Shore Capital, which doesn’t see Nordstrom as the best partner for ASOS. ‘We did not think ASOS needed this, given its established online presence, and we are concerned it will dilute the ASOS brand equity if the customer demographics of the two businesses do not align,’ warns the broker.

SHARES SAYS: The Nordstrom joint venture is a departure for ASOS but it has potential. Keep buying ASOS’s shares.

‹ Previous2021-07-15Next ›

magazine

magazine