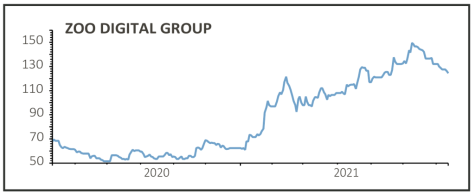

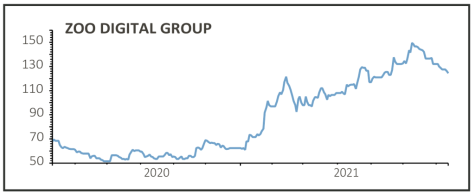

Zoo Digital (ZOO:AIM) 121.24p

Gain to date: 0.2%

Original entry point: Buy at 121p, 13 May 2021

We see exciting times ahead for Zoo Digital (ZOO:AIM) but investors should be prepped to bide their time as it pushes ahead with its invest to grow strategy.

To recap, the Sheffield and Los Angeles-based business runs an in-house designed, multi-tools technology platform in the cloud that allows media owners to repackage their TV and film content for different geographies, languages, formats and technologies.

The investment in the business means profit is currently lagging revenue growth, something that will take time to even out. In the 12 months to 31 March 2021 revenue and gross profit increased 33% and 35% respectively yet the company fell $3.6 million into the red at the pre-tax profit level.

Content creators have been focusing on back catalogues while production was slow or shutdown entirely during the pandemic but this should start to change through the rest of 2021 and beyond as vaccine availability sees restrictions loosen globally. This is illustrated by analysts at Stifel trimming 2022 forecasts but raising expectations for 2023.

In the meantime, the company is exploring opportunities to establish regional hubs in Asia to make it is easier to bridge content cultural and technical divides, and it is also looking at in-fill acquisitions to add talent and expertise.

SHARES SAYS: Still a buy for the longer term.

‹ Previous2021-07-15Next ›

magazine

magazine