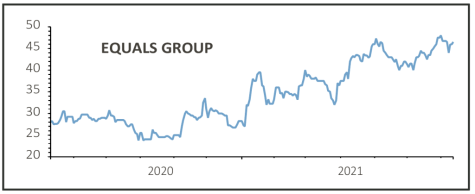

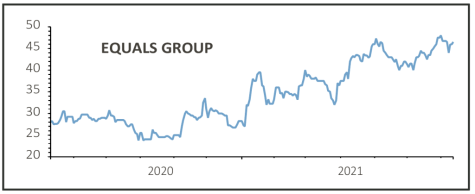

Equals (EQLS:AIM) 47.8p

Gain to date: 11.2%

Original entry point: Buy at 43p, 29 April 2021

Global payments group Equals (EQLS:AIM) posted a strong first half trading update on 8 July, showing revenue growth of more than 20% compared with the first six months of last year even without a meaningful recovery in travel-related foreign exchange revenues.

In fact, travel-related activity made up less than 5% of group turnover compared with more than 30% historically, which not only shows how far the firm has diversified since the onset of Covid but also the potential upside to revenues when normal overseas travel is back on the agenda.

The majority of the growth is coming from the Equals Money suite of products aimed at corporate customers, with the firm seeing record levels of international payment transactions and record activity on its Spend platform in the second quarter.

Having turned cash flow positive at the end of last year, the firm now boasts £9.2 million of cash on hand and is claiming £1.3 million in R&D credits for last year.

Encouragingly, the shares have pushed on despite uncertainty over the 22.4% stake held by activist investor Crystal Amber (CRS:AIM), which itself has become the target of an activist who aims to veto the fund’s continuation vote in November, potentially triggering a break-up and the liquidation of its holdings.

SHARES SAYS: Keep buying.

‹ Previous2021-07-15Next ›

magazine

magazine