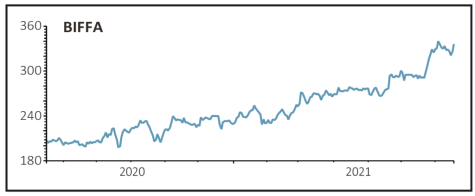

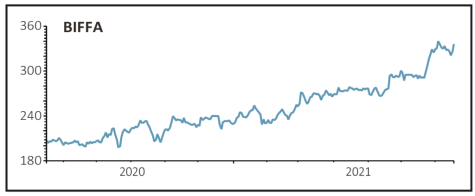

Biffa (BIFF) 338.9p

Gain to date: 25.7%

The fundamentals of waste management firm Biffa (BIFF) and its share price have been progressing well since our buy call in March.

Consensus earnings estimates have since increased around 20% according to Refinitiv data, while management said first quarter trading was well ahead of its expectations, because of faster recovery in the UK economy since restrictions started to be lifted.

In the first three months of the new financial year revenue is up 10% compared with pre-pandemic levels, helped by contributions from acquisitions.

Meanwhile, volumes in the core industrial and commercial collections business are back to July 2019 levels, ahead of company expectations of around 95% of those levels.

Management also highlighted some near-term challenges caused by a national shortage of HGV (heavy goods vehicles) drivers which is being exacerbated by Covid-related absences and reported supply chain issues, but the company said it was carefully managing them.

The positive first quarter update led Numis to upgrade its operating profit estimate by 10% and pre-tax profit by 14%.

SHARES SAYS: Keep buying as the outlook for Biffa remains positive with continued growth opportunities to consolidate a fragmented market.

‹ Previous2021-07-22Next ›

magazine

magazine