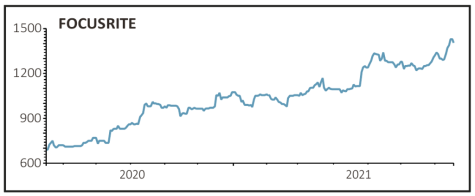

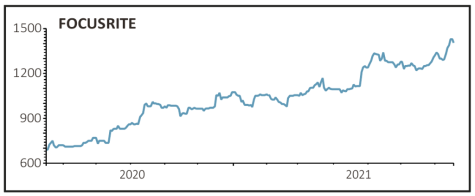

Focusrite (TUNE:AIM) £14.16

Gain to date: 106.1%

Music and audio products firm Focusrite (TUNE:AIM) continues to mark record share price highs driven by earnings upgrades.

The company’s latest trading statement (20 Jul) once again lifted revenue and profit expectations for the financial year to 31 August 2021.

Focusrite has done well as musicians, both from the professional and amateur ranks, have been forced to record at home, creating demand for the company’s hardware and software. Expansion into providing equipment for areas such as the booming podcasting space and film and television dubbing has also helped.

In addition to the beneficial effect on profit through increased revenue, the company has experienced a ‘substantial decrease’ in travel and trade show expenses due to Covid restrictions which will result in full year profits being ‘significantly ahead’ of market expectations, which is usually code for at least a 10% beat.

The main fly in the ointment is a shortage of semi-conductors and other components which is making it difficult to meet strong levels of demand. The board also stressed the one-off nature of the cost savings from reduced live performances and this could make it tough to beat this year’s earnings next year.

SHARES SAYS: The stock has had a great run but now seems a sensible time to book a healthy profit.

‹ Previous2021-07-22Next ›

magazine

magazine