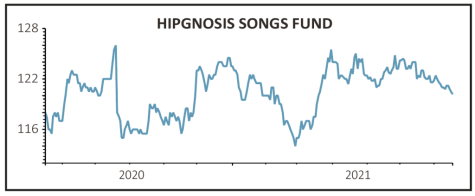

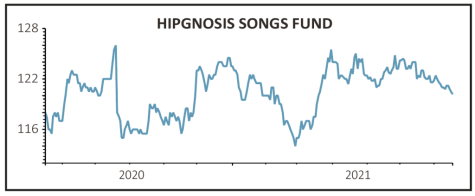

Hipgnosis Songs Fund (SONG) 121p

Gain to date: 4.8%

Original entry point: Buy at 115.5p, 18 June 2020

Members of Parliament have called for changes to the music streaming system to ensure fair pay for songwriters. The current system typically sees the songwriter receive about 16% of royalty revenue, with the rest going to record labels and streaming platforms.

Allowing the songwriter to receive 50% of royalties could potentially benefit Hipgnosis Songs Fund (SONG) as it owns the rights to a large catalogue of music.

It buys the rights to songs from big name artists and producers, giving them a lump sum of cash upfront in exchange for Hipgnosis receiving future royalty income from the songs when they are used in films, adverts, performed live or played on the radio, for example.

On the inquiry into the economics of streaming by the DCMS committee, Numis says: ‘It is ultimately a debate about splitting up the streaming pie and therefore there will be winners and losers depending on what exact ownership rights of a royalty is held. That said, the growth in streaming is expected to be a tailwind for total revenues.’

SHARES SAYS: Encouraging but don’t expect any near-term changes to the system. We said to buy Hipgnosis for income and it continues to deliver, reporting a 5% increase in its quarterly dividend to 1.3125p on 20 July. Keep buying.

‹ Previous2021-07-22Next ›

magazine

magazine